29 January 2025

Solana has faced significant downward pressure in the past few days, dropping over 15% as the broader crypto market experiences a selloff driven by speculation and uncertainty. Meme coins, which have been a major catalyst for Solana’s recent growth, are now seeing massive losses, raising concerns about the blockchain’s short-term outlook. With meme coin projects struggling, Solana’s ecosystem is taking a hit, as these tokens have contributed significantly to its transaction volume and network activity.

Top analyst IncomeSharks shared a technical analysis on X, revealing that Solana still has room to go lower, attributing the decline to a major flush in the meme coin sector. The hype that fueled Solana’s price rally in previous weeks is fading, and liquidity is drying up as traders take profits or cut losses. If Solana fails to hold key support levels, another leg down could follow.

While long-term sentiment remains bullish for Solana, the short-term price action suggests that volatility will persist. Investors are closely watching whether Solana can stabilize or if further downside is imminent. The coming days will be crucial in determining whether this correction is just a dip or the start of a deeper pullback.

Solana Facing Selling Pressure

Solana is trading at a key level after enduring days of selling pressure and heightened volatility. As one of the most popular blockchains for meme coin creation and trading, Solana has benefited from surging speculative interest in these assets. When meme coins perform well, Solana tends to see increased demand, boosting its price. However, the current market conditions are unfavorable for meme coins, leading to a significant downturn in Solana’s price performance compared to other altcoins.

Top analyst IncomeSharks shared a technical analysis on X, stating that Solana’s price still wants to go lower as meme coins face a major flush. The broader crypto market has entered a period of uncertainty, and meme coin hype is fading as liquidity dries up. This has created additional selling pressure on Solana, as traders exit high-risk positions.

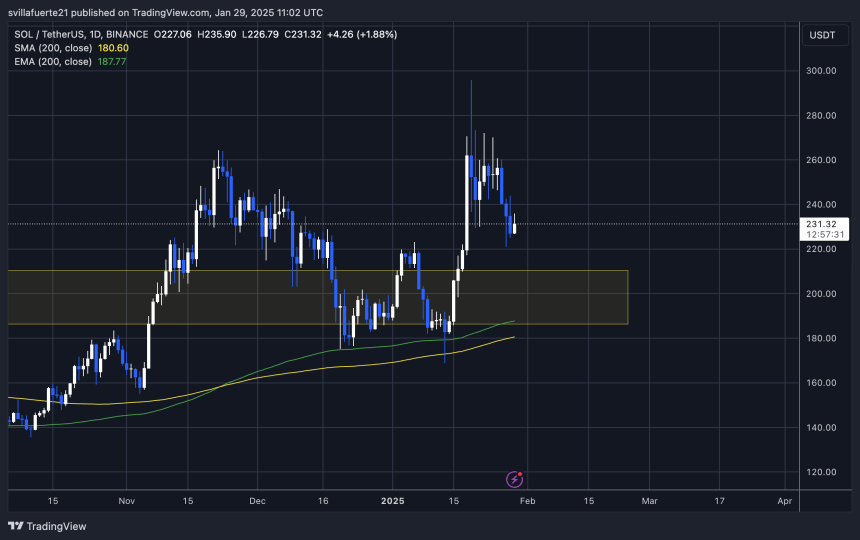

Solana has dropped over 15% in the past week, failing to hold critical support levels as bearish sentiment takes over. The price recently dipped below $230, erasing weeks of gains. IncomeSharks sets a bearish target around the $200 mark, a level not seen since January 16. If Solana fails to hold above $220, the selloff could accelerate, driving the price toward the next major support zone.

However, not all analysts are bearish. Some traders believe Solana’s dip is a temporary retrace rather than the start of a prolonged downtrend. If buyers step in around the $220-$225 range, Solana could stabilize and attempt a recovery. A push back above $250 would indicate renewed strength, with bulls aiming for a return to previous highs.

Price Action Details: Showing Strength

Solana (SOL) is trading at $231 after enduring days of selling pressure and increased volatility. The price reached an all-time high of approximately $295 on January 19, but since then, SOL has faced a sharp 25% decline in less than ten days. This significant drop has raised concerns among traders and investors, as Solana struggles to find strong support amid broader market uncertainty.

For bulls to regain control and reverse the short-term bearish trend, SOL must hold above the current levels and push past the $244 mark. Breaking above this resistance would indicate renewed buying pressure and confirm a potential trend reversal. If SOL manages to reclaim this level, a surge toward $260 could follow, signaling a recovery phase.

However, failure to maintain support above $230 could lead to further downside. A break below this critical level would expose SOL to deeper losses, with the next major support zone around the $200 mark. A decline to this level would mark an even steeper correction, potentially erasing more of its recent gains.

Featured image from Dall-E, chart from TradingView