30 June 2025

A seasoned crypto analyst has warned that the recent Bitcoin (BTC) price action may be setting the stage for major liquidity traps, echoing patterns seen in past cycles. As the leading cryptocurrency aims for new all-time highs, the pundit suggests that market makers could be deliberately engineering conditions for bear traps before triggering a powerful breakout.

Bitcoin Path To ATH Riddled With Liquidity Traps

Crypto market expert Luca has shared intriguing insights into Bitcoin’s latest price behavior, arguing that the market may be entering a classic liquidity trap phase allegedly orchestrated by market makers. The analyst stated in an X (formerly Twitter) post that Bitcoin’s price action since topping out in late May 2025 has followed a suspicious pattern. He noted that despite experiencing several price rallies, not a single local high has been swept in the past few weeks.

Luca suggests that this rare price structure could be a deliberate setup, giving the illusion of stability and offering false conviction in bearish positions. The analyst warns that market makers have possibly influenced this market behavior by baiting shorts into entering or holding positions with the assumption that Bitcoin could continue to be capped below resistance. Ideally, this underpins the theory that bear traps are potentially being set as BTC gears up for its next bullish rally.

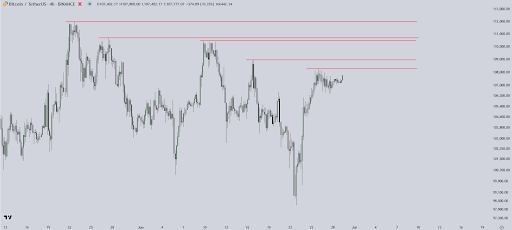

Notably, multiple key resistance levels are now stacked tightly between $109,000 and $112,000, as highlighted on the analyst’s 4-hour Bitcoin chart. While BTC has been consolidating just below these levels, forming what appears to be a potential base, Luca argues that this price behavior is not a coincidence. Rather than market weakness, he believes the subdued price action reflects a calculated effort by market makers to encourage bearish complacency.

The pundit interprets the deliberate avoidance of liquidity above these resistance lines as a signal that deeper bear traps are possibly being laid. Luca has revealed that this setup could be laying the groundwork for a sudden short squeeze, potentially igniting a sharp move toward a new all-time high for Bitcoin.

Analyst Says BTC 2024 Breakout Back In Play

Adding historical context to his analysis, Luca compares the current market structure to a prolonged consolidation phase observed throughout 2024. On the second 8-hour chart, a clear trendline of resistance can be seen capping Bitcoin’s upside for most of the previous year.

The chart shows that price action consistently failed to break above the descending barrier, with multiple attempts being rejected between March and October. Each rejection was marked by unswept highs—similar to the current market setup and suggesting that shorts were systematically being protected.

This compression finally resolved in November 2024, when Bitcoin erupted through the resistance and launched a parabolic move to new highs. That breakout was fueled by the exact mechanism Luca now believes is in motion. With historical patterns now resurfacing, the analyst maintains that Bitcoin’s ongoing suppression and untouched highs are part of a blueprint that indicates a possible bullish move toward uncharted price territory.