24 March 2025

Ondo Finance is trading at a pivotal moment as the broader crypto market shows signs of potential recovery. While bullish sentiment is slowly building, macroeconomic uncertainty and escalating global trade war fears continue to inject volatility into financial markets. For ONDO, however, analysts are closely watching for a breakout that could signal the start of a new uptrend.

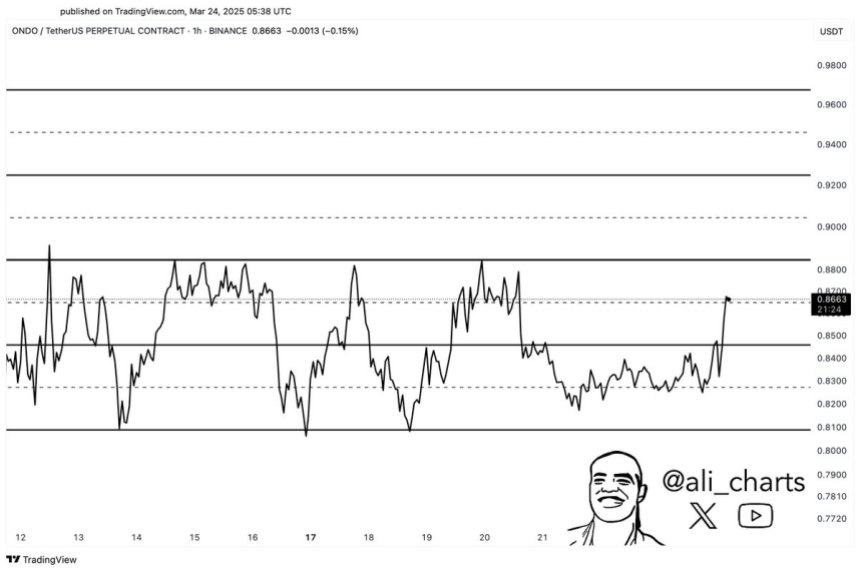

Top crypto analyst Ali Martinez shared a technical outlook on X, highlighting that ONDO is currently trading within a narrow parallel channel. According to Martinez, a break above the upper boundary of this channel at $0.89 could trigger bullish momentum, potentially pushing ONDO into higher prices.

With ONDO already capturing attention as a leader in the real-world asset (RWA) sector, this technical setup could play a major role in setting the tone for the asset’s short-term direction. As investors closely monitor global economic developments and market sentiment, a confirmed breakout above the $0.89 resistance could solidify ONDO’s place as one of the stronger performers in the coming weeks.

ONDO Prepares For Breakout As Market Eyes RWA

Ondo Finance has emerged as one of the most prominent real-world asset (RWA) projects in the crypto space, securing strategic partnerships with major players like Ripple and World Liberty Financial. These alliances have helped position ONDO at the forefront of tokenized finance, fueling optimism among investors who expected strong performance throughout 2024.

However, ONDO’s price action has failed to match the enthusiasm. Since mid-December, ONDO has lost over 65% of its value, tumbling from local highs and creating an environment of fear and uncertainty. Many long-term holders remain cautious, especially with macroeconomic volatility and ongoing trade war concerns dragging down market sentiment.

Despite the sharp correction, analysts are beginning to spot signs of a potential turnaround. Martinez’s technical analysis reveals that ONDO is currently trading within a narrow parallel channel—a pattern that typically precedes significant price movements. According to Martinez, a breakout above the channel’s upper boundary at $0.89 could trigger bullish momentum and lead to a quick rally toward the $1 mark.

If ONDO can reclaim higher resistance levels and sustain upward movement, it would reinforce its position as a leader in the RWA narrative. The coming days will be crucial for ONDO as bulls attempt to flip the trend and capitalize on the momentum building beneath the surface.

Price Holds Near Resistance As Bulls Eye $1.08 Breakout

ONDO is currently trading around $0.88 after several days of sideways consolidation just below the $0.90 resistance level. This narrow price action reflects growing indecision in the market as bulls attempt to regain momentum after weeks of heavy selling pressure. While the overall trend remains cautious, ONDO’s proximity to key technical levels has caught the attention of traders watching for a breakout.

To confirm a sustainable recovery, ONDO must break and hold above $0.90 and push toward the 200-day moving average (MA) and exponential moving average (EMA), both sitting near the $1.08 mark. Reclaiming these indicators would signal a shift in momentum and provide strong confirmation of an uptrend forming. A successful move above $1.08 could open the door for a larger rally as confidence in the RWA narrative strengthens.

However, if bulls fail to break above $0.90 in the coming sessions, ONDO risks falling back into lower support zones. Continued rejection at this level may trigger a retest of previous demand around $0.80 or lower, potentially extending the consolidation phase. For now, ONDO remains on the edge of a breakout or deeper retrace, with the next move likely defining short-term direction.

Featured image from Dall-E, chart from TradingView