25 October 2025

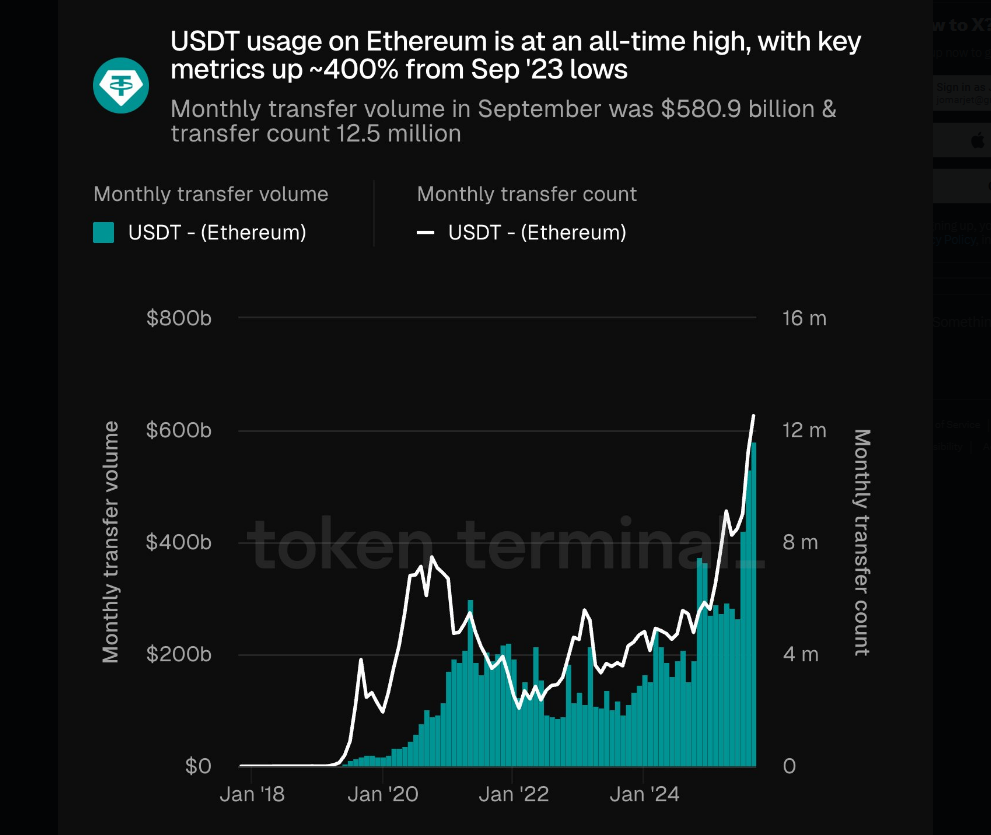

Reports have disclosed a 400% rise in stablecoin transfers on Ethereum over the last 30 days, pushing total transfer volume to $581 billion and more than 12.5 million transfers, according to Token Terminal.

The stablecoin market cap on Ethereum now tops $163 billion. At the same time, Ethereum has fallen about 4.50% in the past week, and briefly tested support near $3,738, which some traders called a buying opportunity.

Whales Step In With Large Buys

On-chain trackers show heavy buying from large holders. A newly created wallet, 0x86Ed, spent $32 million to pick up 8,491 ETH in roughly three hours, based on Arkham Intelligence records.

Another high-profile account monitored by LookOnChain moved 284K USDC into Hyperliquid after recent liquidations, apparently to maintain long exposure to ETH.

Reports say October’s stablecoin transaction volume on Ethereum passed $1.91 trillion for the second time on record, a sign that big flows are still moving through the network.

USDT usage on Ethereum is at an all-time high, with key metrics up ~400% from Sep ’23 lows.

Monthly transfer volume in September was $580.9 billion & transfer count 12.5 million.

At a ~$500 billion valuation, @Tether_to is the most valuable business building on @ethereum. pic.twitter.com/Z83e68NO8C

— Token Terminal

(@tokenterminal) October 13, 2025

Institutions Are Increasing Exposure

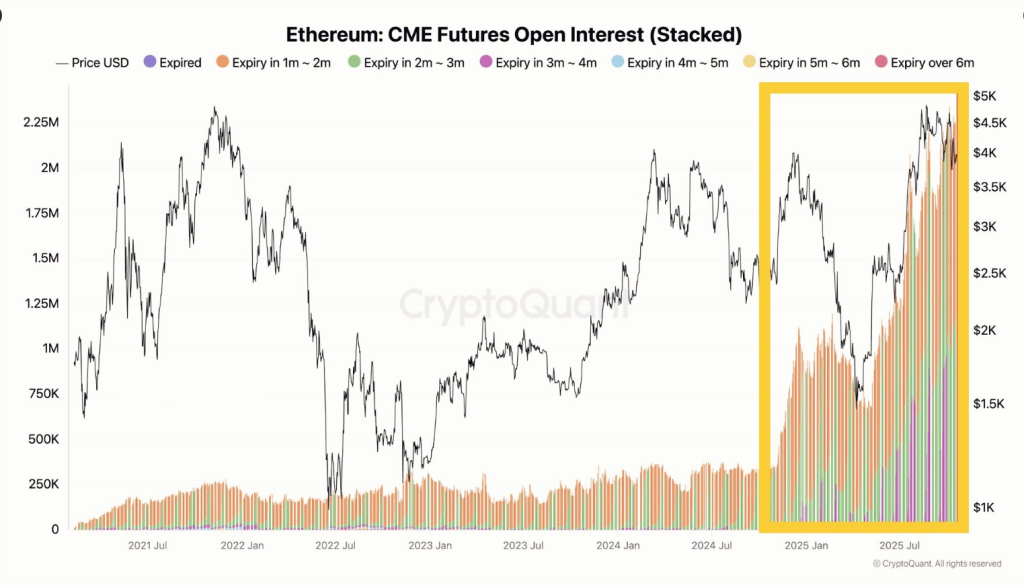

CryptoQuant and exchange data point to a rise in institutional interest. CME futures open interest for ETH has climbed, suggesting larger players are setting positions ahead of a potential price move.

Fundstrat’s Tom Lee was cited saying ETH could head toward $5,000 if the ETH/BTC ratio clears the 0.087 resistance. Matt Sheffield, CIO at Sharplink Gaming, told analysts that past liquidations did not stop real use and that the scale of payments on legacy systems — SWIFT processes about $150T a year — shows how much room exists for stablecoins to grow on Ethereum.

Big money is flowing into #Ethereum institutional interest is clearly rising fast….

The surge in CME futures open interest signals that smart money is gearing up for a major $ETH move ahead… pic.twitter.com/8oUfApDeoP

— BitGuru

(@bitgu_ru) October 23, 2025

Technical Setups Show Clear Levels To Watch

Technical analysis experts have noted a confluence of indicators near today’s prices. Currently, ETH is trading near $3887, just above the significant Fibonacci retracement of 0.618 at $3781.

The 0.786 retracement is near $3,640 with the level of formal invalidation set at $3443. Some technicians have pointed to a triple bottom trading pattern around $3600, as well as the potential for a new accumulation reading from a Wycoff re-accumulation pattern which could lead to higher targets (notably $5125 at the 1.618 extension.

Balance Between Flow And Risk

In sum, with heavy stablecoin flow, whale buying, and increasing interest in futures, this has created a basis for bullish calls into the $5000 range.

That said, chart patterns fail, on-chain movements may not lead to changes in price, and traders who remain cognizant of the ETH/BTC ratio, the invalidation line at $3443, and whether large transactions are transferring or being used for longer-term custody, may get more clarity in the coming sessions.

Featured image from Motion Island, chart from TradingView