24 October 2025

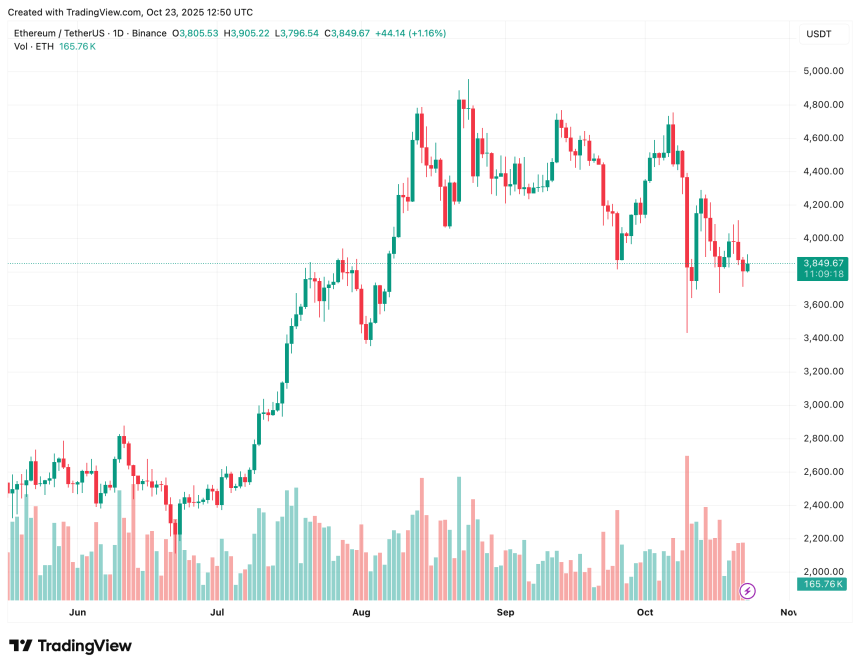

Ethereum (ETH), the second-largest cryptocurrency by market cap, continues to trade slightly below the psychologically important $4,000 price level, following the brutal drawdown on October 9, which saw the digital currency test the support at around $3,435.

Ethereum Stays Above Realized Price – Bullish Momentum Soon?

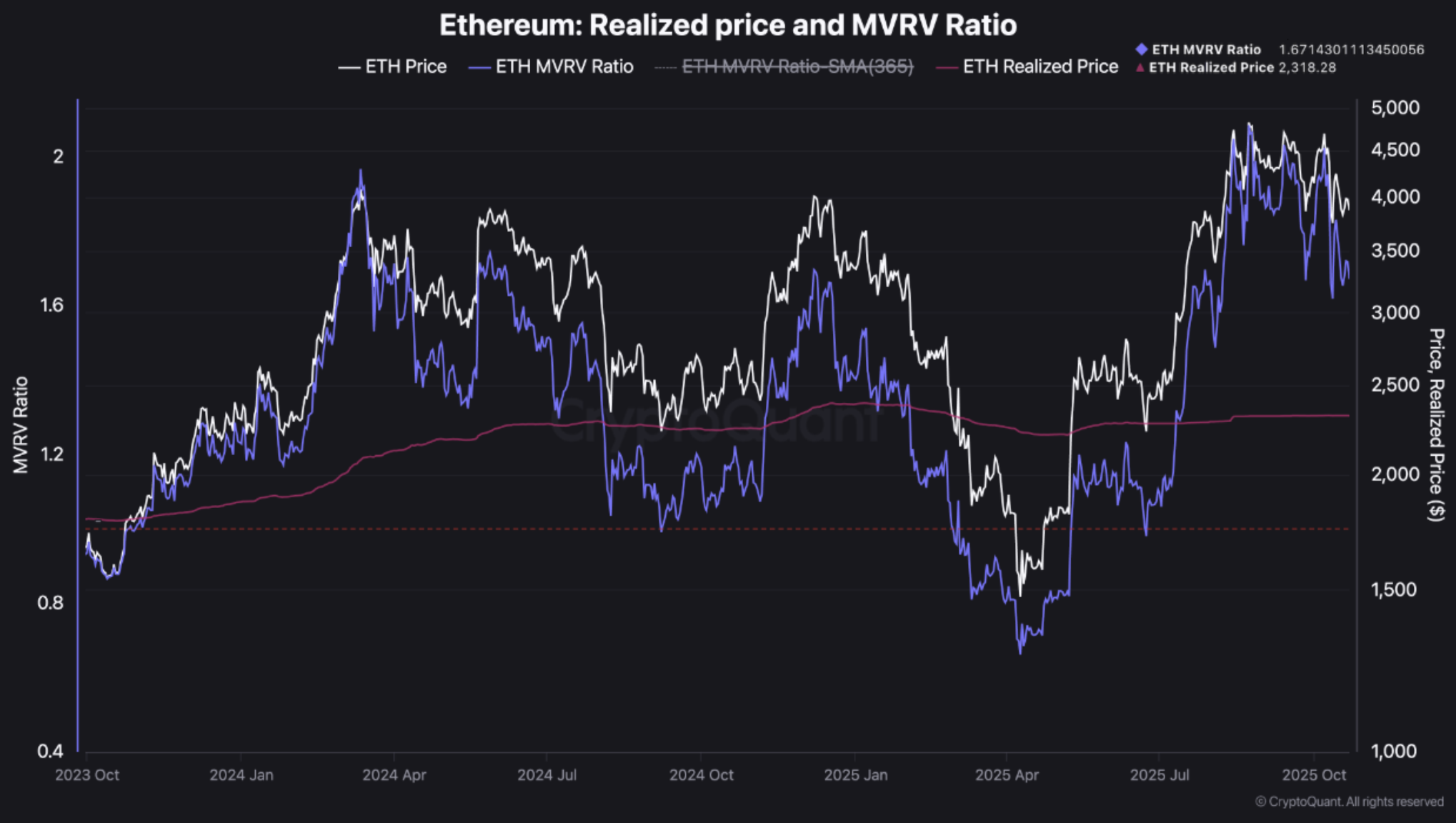

According to a CryptoQuant Quicktake post by contributor TeddyVision, Ethereum is trading above its Realized Price at approximately $2,300. Dubbing the price level a “fundamental support zone,” the analyst said that historically, any dips below this level have marked a capitulation phase.

For the uninitiated, Realized Price represents the average cost basis of all ETH holders, calculated by dividing the total value of all ETH at the time they last moved on-chain by the current circulating supply.

Realized Price effectively shows the “true” average price investors paid, serving as a key indicator of whether the market is in profit or loss. As long as ETH trades above Realized Price, the market structure is likely to remain bullish.

The analyst also highlighted Ethereum’s Market Value to Realized Value (MVRV) ratio. Notably, ETH holders are currently, on average, at 67% profit relative to their cost basis. This metric gives two major hints about the current market.

First, it shows that although the market is profitable, it is still far from “overheated” levels. Second, it indicates that market participants are confident about the market’s upward momentum, but not quite euphoric.

To explain, the MVRV ratio compares the market value of an asset to its realized value. A higher MVRV indicates holders are sitting on larger unrealized profits – often signaling potential overvaluation – while a lower MVRV suggests undervaluation or market fear.

Further, TeddyVision noted Ethereum’s reaction from the Upper Realized Price Band, which is currently located around $5,300. The analyst remarked:

Price pulled back before reaching the “Overheating Zone. This isn’t a reversal – it’s a consolidation phase after distribution, a healthy cooldown without structural damage.

Finally, spot inflows of ETH to crypto exchanges are also slowing down, hinting that the next leg up for the digital asset will likely depend on fresh liquidity, and not leverage. To sum it up, Ethereum is slowly moving from the distribution phase to the consolidation phase.

Is It A Good Time To Buy ETH?

While providing reliable future predictions in the crypto market remains a challenging task, fresh on-chain and exchange data point toward ETH regaining its bullish momentum. For instance, Binance funding rates recently hinted that ETH could surge to $6,800.

Similarly, ETH reserves on exchanges continue to fall at a rapid pace. Earlier this month, ETH supply on exchanges hit a multi-year low, increasing the probability of a potential “supply crunch” that can dramatically increase ETH’s price.

That said, crypto analyst Nik Patel recently cautioned that ETH’s price correction may not yet be fully over. At press time, ETH trades at $3,849, up 0.3% in the past 24 hours.