1 October 2025

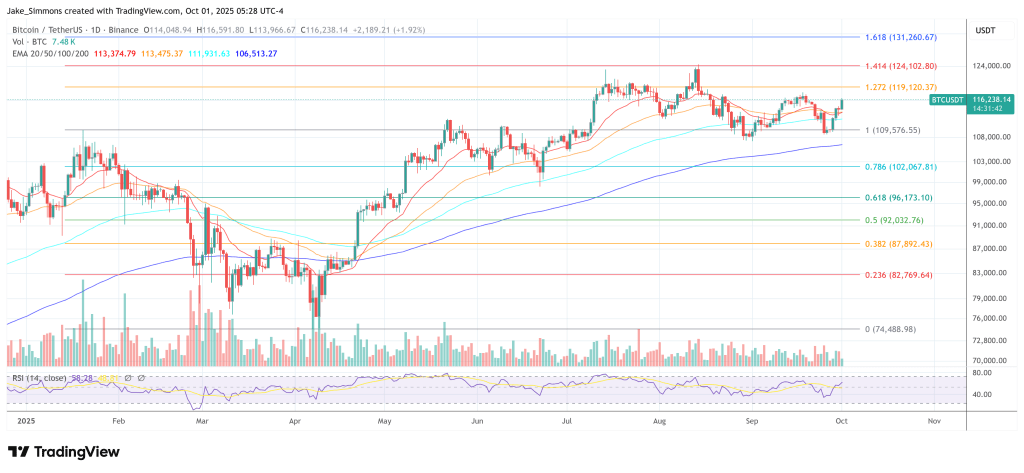

Crypto analyst Trader Mayne is cautioning that Bitcoin may be setting up for a sharper drawdown before resuming its broader uptrend into year-end, arguing that a “$98,000 weekly liquidity level” sits uncollected below price and could be targeted early in October.

Two Price Scenarios For Bitcoin

In a video analysis posted on September 30 titled “Did Bitcoin Just Top? The Signal Everyone’s Ignoring…,”Mayne outlined a two-track playbook: a tactical long on a lower-timeframe liquidity sweep that could precede a deeper correction, and, if that setup fails, a decisive flush that takes out $98,000 before a fourth-quarter continuation higher.

“TLDR — I think we are due for a larger correction soon, to take out the $98k weekly liquidity level,” Mayne wrote in his teaser via X, adding that “there may be a short term long set up that precedes that correction” and that he still expects higher prices in Q4, making “an early dump…a buying opp.”

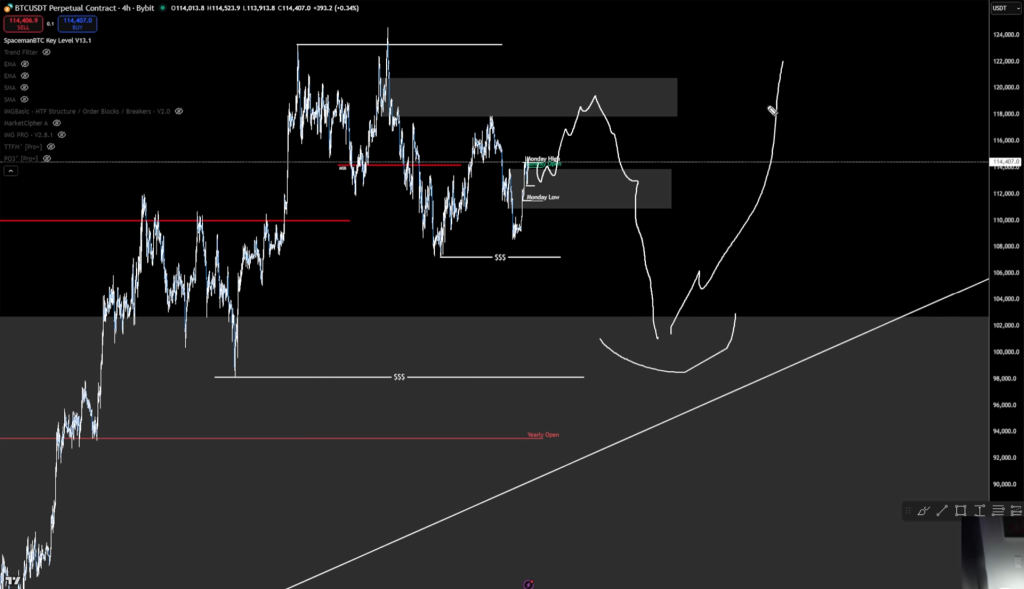

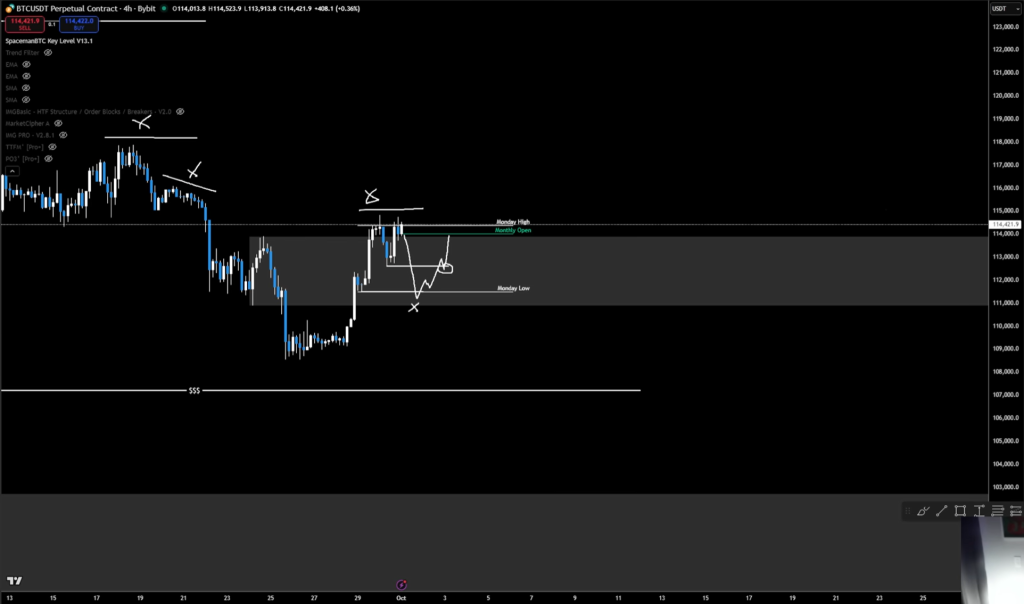

On Bitcoin’s structure, Mayne said the market has respected his recent roadmap: a push up, a retest, and now a decision point defined by higher-timeframe “breaker” levels and intraweek lows. “We had the daily flip bullish on Bitcoin, right? We closed above the breaker,” he said, noting that while the monthly chart is also constructive, “the weekly chart is technically bearish.”

With two higher timeframes leaning bullish against a soft weekly, he is looking to the four-hour chart to synchronize the next trade. “If the H4 is bullish, which it is, if I take a setup on some sort of liquidity run on the H4, that’s going to sync me back up with the daily at least.”

The immediate trigger, in his view, is a sweep of local lows to tighten risk rather than “aping” into a broad retest with a wide invalidation. “I would like to see one of these H4 little liquidity pools here get run and then…that becomes my setup and my stop is tight. I have clear targets over here,” he explained.

He highlighted “Monday’s low” as a relevant pivot that, if taken, could produce a mean-reversion long into a nearby daily bearish breaker and prior highs. “Maybe we even run this first, right? And then get the pullback. But either way, that’s what I’m looking for on Bitcoin here.”

Mayne underscored that invalidation is non-negotiable. If price loses the intraweek baseline on a closing basis, he abandons longs and prepares for a larger washout. “If Bitcoin gets an H4 close below here…we’ll probably nuke to $98,000,” he said, tying the trigger to a failure back below Monday’s low and the range floor. In other words, the same liquidity dynamics he seeks to exploit for a tactical bounce could, if they break, accelerate the “$98k” clean-out he believes the weekly chart still “owes.”

One Last Dip Before Q4 Fireworks

He mapped the Ethereum structure as analogous, with the daily and 12-hour trends flipping constructive into a weekly order block, but with the same need for a precise entry via a low-timeframe liquidity grab. “ETH very similar, right? We had the daily flip bullish…we’ve got the breaker. It’s retesting this order block here,” he said. He described an H12/weekly combination where a “weekly SFP” and “structure break” are in motion, but stressed placement of the stop remains “tricky” unless a Monday-low sweep offers a cleaner trigger. “To me, ETH looks good here to fill in some of this…assuming we can get that setup,” he added.

The conditional nature of the plan is central. Mayne is willing to attempt continuation longs into nearby resistance if and only if the market prints the sweep that tightens his invalidation. Failing that, he expects downside first. “If we don’t get this little setup to here, I think there’s a very strong chance that we’re going to, you know, at least do one of these, right? and nuke this liquidity here and then get the real move up,” he said. He reiterated the timeframe check: “If we get an H4 close below Monday’s low [near $111,000]…all bets are off and we might actually start the month of October down.”

Despite the caution, the macro-tactical stance remains buy-the-dip for Q4. Mayne repeatedly framed any early-October weakness as an opportunity rather than the start of a cyclical top. “Ultimately, I’m of the mindset that…this dip that may come, whether it’s from right here or after a push higher…is a dip we want to buy ’cause we’re in the endgame here,” he said. “It’s October, November, December. We’re in Q4… I believe we trade higher in Q4.”

At press time, BTC traded at $116,238.