9 January 2025

Data shows the cryptocurrency derivatives market has suffered a high amount of liquidations in the past day as Bitcoin and other assets have crashed.

Bitcoin, Ethereum Saw Notable Plunges During Past Day

The last 24 hours have been red for digital assets, with a bulk of the market observing a drawdown of more than 5%. Bitcoin has been no exception, as its price has slipped under the $95,000 level.

It was only a couple of days back that the asset had shown a sharp recovery above the $102,000 mark. The steep crash since then would suggest the investors didn’t believe the rally would have legs, so they decided to take their profits while they could.

Ethereum, the second largest cryptocurrency by market cap, has had it even worse than Bitcoin, with its price coming down to $3,350 after a drop of almost 8% during the past day.

With its plunge, Ethereum has basically retraced all the bullish momentum that had come with this new year of 2025. Bitcoin still retains some of its gains, but if the current trajectory continues, it wouldn’t be long before it meets the same fate as well.

With all the carnage that the digital asset sector has seen, it would be expected that the derivatives side of the market would likewise have gone through some chaos.

Crypto Longs Have Just Taken A Massive Beating

According to data from CoinGlass, a mass amount of liquidations have piled up on derivatives exchanges during the past day. “Liquidation” refers to the forceful closure that any open contract undergoes after it has amassed losses of a certain degree (the exact percentage of which may differ between platforms).

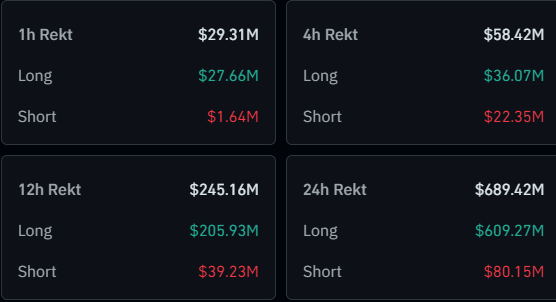

Below is a table that breaks down the relevant numbers related to the latest cryptocurrency liquidations.

As is visible, a total of $689 million in contracts have been flushed in the last 24 hours. Out of these, over $609 million of the positions involved were long ones. This means an overwhelming 88% of the liquidations affected the traders betting on a bullish outcome for the market.

Given the crash that the cryptocurrency sector has gone through during this window, it’s not exactly a surprise to see this disparity between long and short liquidations.

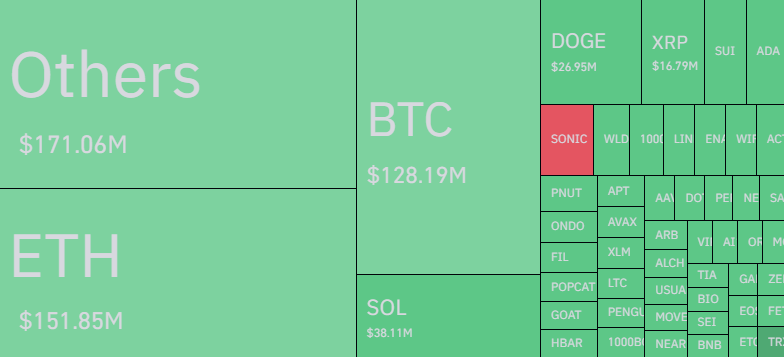

In terms of the contributions to the squeeze by the individual symbols, Bitcoin has interestingly not topped the charts this time around. Instead, Ethereum has been king with almost $152 million in liquidations.

The fact that Ethereum’s drawdown has been more significant than Bitcoin’s has part to play in this, but it may not be the full story. It’s possible that the trend is an indication that the speculative interest around ETH has been particularly pronounced recently.