6 May 2025

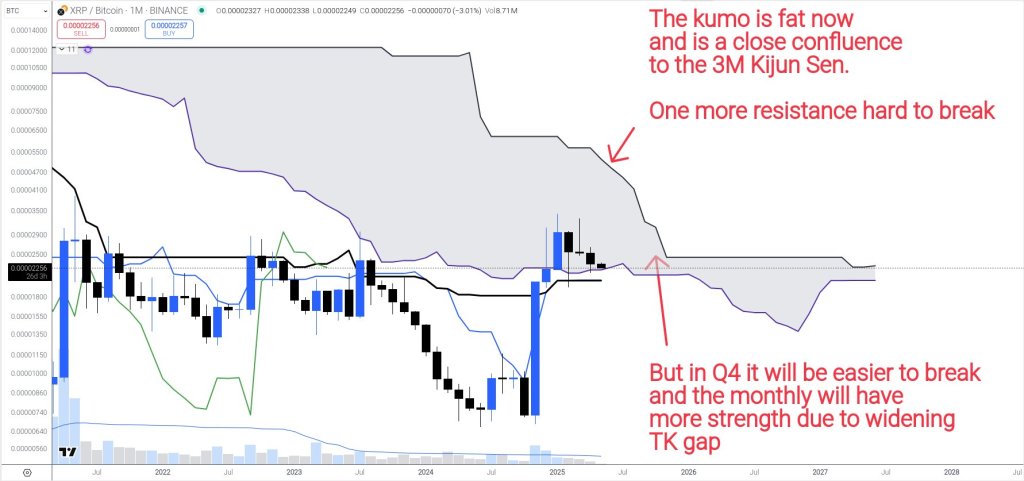

In a post on X, crypto analyst Dr Cat (@DoctorCatX) laid out a detailed road map for the XRP/BTC pair that hinges on both the thickness of the monthly Ichimoku cloud and Bitcoin’s eventual trajectory toward six-figure territory.

The analyst’s working target is a test of 5,200 satoshis by June—a level that “must fight three obstacles at the same time: the quarterly Kijun Sen, a bearish TK cross with a decent gap between Tenkan Sen and Kijun Sen, and the Chikou Span resistance,” he wrote. As a result, he assigns “around 90 percent” odds that the first assault on that level will fail to close a quarterly candle above the Kijun, noting that on a three-month chart “a few candles/tries” implies a time horizon “= a year and more.”

How High Can XRP Price Go?

The accompanying monthly chart, shows a fat kumo acting as near-term ceiling and forming “a close confluence to the 3M Kijun Sen.” One annotation highlights “one more resistance hard to break,” while another points out that by the fourth quarter the kumo is forecast to thin dramatically, giving any later attempt “more strength due to [a] widening TK gap.”

Dr Cat sees two pathways once May trading is underway. If momentum carries through and the 5,200-satoshi zone is pierced during May–June, “we attack in May and June and get $4.5-$6 then reject at least initially (but it might be also rejecting for good).” That dollar translation, he clarified, assumes Bitcoin fluctuating between $90,000 and $120,000: “If BTC is at $90K this is roughly $4.5 and if it is at $120k this is roughly $6.”

The second scenario involves the weekly chart slipping into range-bound behavior, triggering either “a complete flop” or “long consolidation (think months).” Prolonged coiling would shrink the gap between Tenkan and Kijun, erode the thickness of the monthly cloud and, crucially, dull the influence of the quarterly Kijun. “In this case,” he argued, “the chance for the moon target of 12K satoshi significantly increases.” Pushed on what that would mean in dollar terms, Dr Cat replied: “30 $ is the same, assuming BTC explodes much higher much later to $250K (probably even $270K), multiply this by 12K satoshi and you get $30.”

The implication is that XRP’s upside ceiling is bound to Bitcoin’s own expansion. A parabolic run in BTC to a quarter-million dollars would effectively scale Dr Cat’s sats-denominated target into a $30 spot price for XRP—roughly a 5,000 percent rally from current levels.

While the analyst’s framework leans heavily on traditional Ichimoku mechanics—cloud thickness, TK gaps and Chikou Span interaction—he repeatedly cautions that quarterly resistance levels do not yield easily. Even a successful penetration this summer would likely be followed by pullbacks before a sustainable break. Conversely, the comfort of an extended base-building phase could allow XRP to confront those same resistances “significantly easier” later in the year, when the cloud is paper-thin.

For traders, the message is that timing and context may matter more than the raw number. Whether XRP first taps the $4-$6 window and retreats or spends months coiling below resistance, the analyst argues that the ultimate escape velocity to double-digit prices is conditional on Bitcoin’s march past its all-time high and toward the $250,000–$270,000 band.

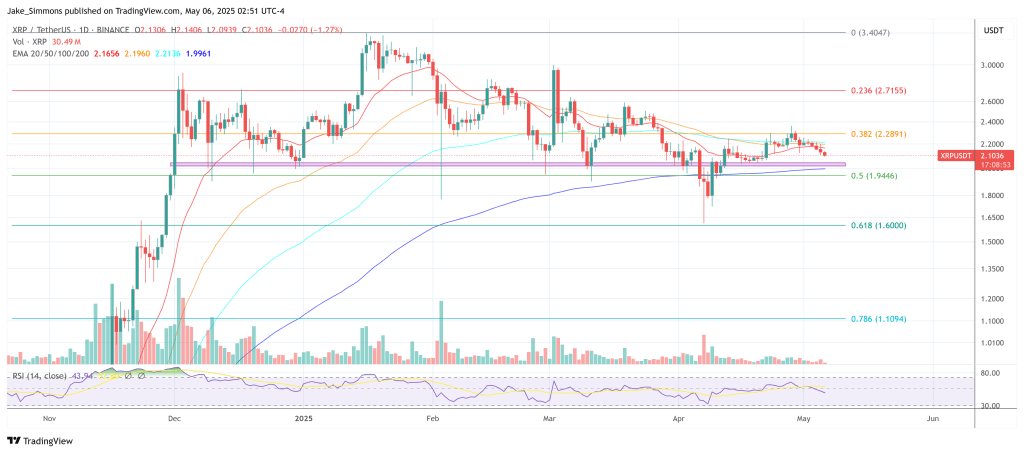

At press time, XRP traded at $2.10.