3 December 2025

Ethereum has reclaimed the $3,000 level after a strong market reaction to improving macro conditions, offering investors a much-needed shift in momentum. The move comes just days after the Federal Reserve officially ended Quantitative Tightening (QT), a policy shift that immediately boosted liquidity expectations across all risk assets. With markets now pricing in an imminent interest rate cut, confidence has begun to return, and ETH is one of the first major assets to respond.

This rebound reflects more than just macro relief. According to data from Arkham, shared by Lookonchain, Bitmine continues to accumulate Ethereum at current prices, reinforcing bullish sentiment at a moment when many traders remain cautious. Bitmine’s persistent buying throughout the correction has become one of the most influential signals for on-chain analysts, suggesting that large players see long-term value even as the market wrestles with volatility.

Reclaiming $3,000 places Ethereum back above a key psychological level, and the combination of supportive macro policy and whale accumulation provides a stronger foundation than the market had just weeks ago.

Bitmine and Linked Wallets Expand Ethereum Holdings

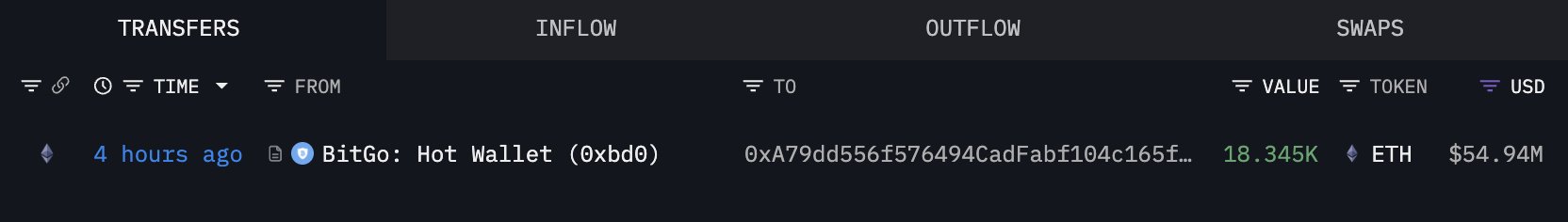

According to data from Arkham reported by Lookonchain, Bitmine has purchased another 18,345 ETH, worth approximately $54.94 million, just a few hours ago. This marks yet another large buy in a growing series of aggressive accumulation moves that Bitmine has made throughout the correction. Their continued willingness to buy at current levels signals strong confidence in Ethereum’s long-term value, even as the market navigates heightened volatility.

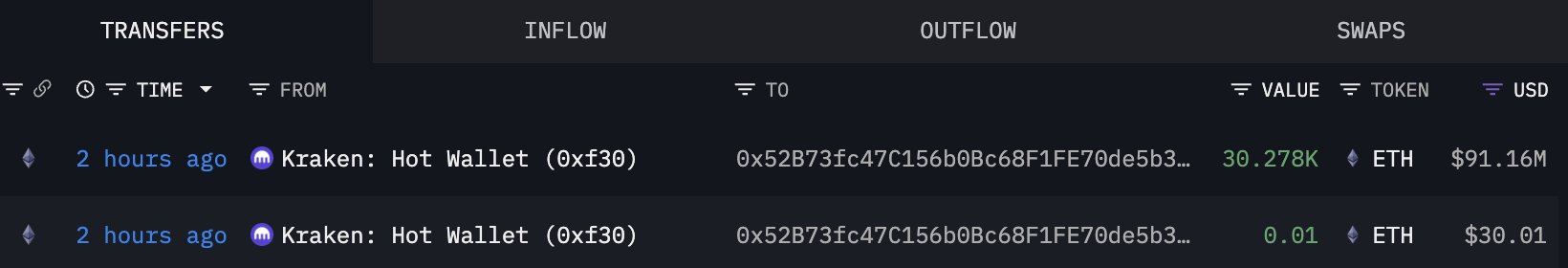

Shortly after this report, Lookonchain highlighted activity from a newly created wallet, 0x52B7, which withdrew 30,278 ETH—valued at $91.16 million—from Kraken. The size and timing of the withdrawal have led analysts to speculate that this wallet may be linked to Bitmine or part of a broader accumulation strategy.

Large withdrawals from exchanges typically indicate that the owner intends to hold the assets off-exchange, often for long-term storage or staking, rather than preparing to sell.

If the wallet is indeed connected to Bitmine, this would bring their latest combined accumulation to nearly 50,000 ETH in a single day. Such behavior suggests strategic positioning ahead of potential macro-driven upside or internal confidence in Ethereum’s recovery.

This kind of synchronized whale activity often precedes significant price shifts, reinforcing the idea that large players are preparing for a stronger market phase.

ETH Reclaims $3,000 But Still Faces Key Resistance

Ethereum’s 3-day chart shows a notable improvement after reclaiming the $3,000 level, but the broader trend still carries signs of fragility. The recent bounce followed a deep corrective move that sent ETH from the $4,500 region down to the $2,700–$2,800 support zone, where buyers finally stepped in with conviction. The strong lower wicks around this area confirm that demand remains active, but Ethereum has yet to fully recover its bullish structure.

Price now trades just below the 50 SMA, which sits near the $3,100–$3,150 zone—an important short-term resistance level. A clean break above this moving average would signal renewed momentum and increase the chances of retesting the $3,400–$3,600 range. Meanwhile, the 100 SMA and 200 SMA remain slightly above price, reflecting the broader downtrend that has dominated since September.

Volume has picked up slightly during the recovery, but it remains muted compared to the selling spikes seen during the drawdown. This indicates cautious buying rather than aggressive accumulation at these levels. To confirm a trend reversal, ETH must close above the 50 SMA and then challenge the cluster of resistance around $3,200–$3,300.

Featured image from ChatGPT, chart from TradingView.com