23 June 2025

Metaplanet has again beefed up its Bitcoin holdings. According to the Tokyo-listed investment firm, it bought 1,111 BTC on Monday for about $118.2 million.

The average price paid was roughly $106,408 per coin. Bitcoin has fallen more than 5% over the last week, trading just above $101,000.

Performance Metrics Climb Higher

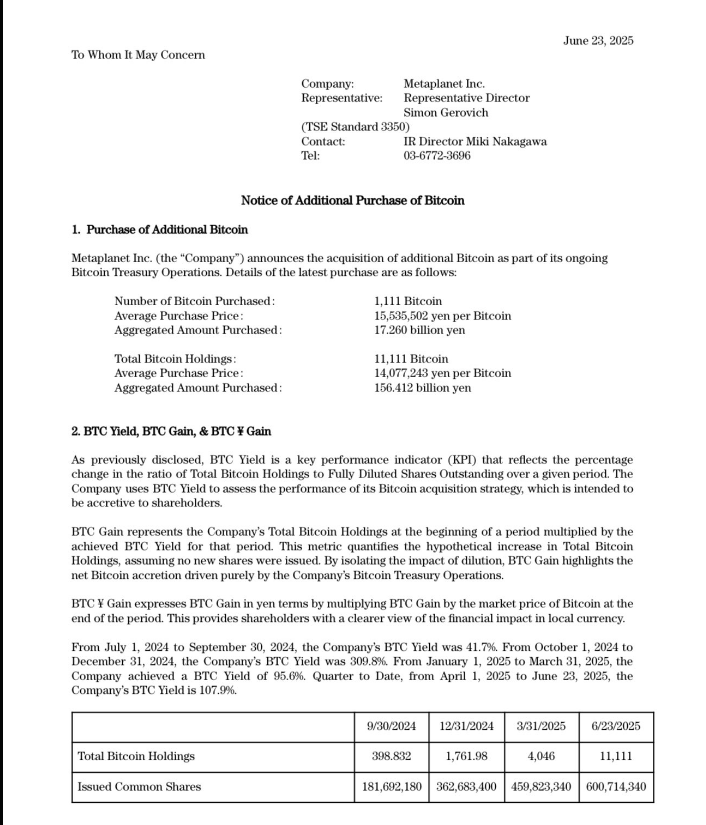

Metaplanet’s own numbers show a quarter-to-date BTC yield of 108%, up from 96% in Q1 and a hefty 310% in Q4 2024. That metric tracks Bitcoin per fully diluted share, so it puts the firm’s strategy under a clear spotlight.

Based on reports, the company gained 4,367 BTC valued at $451 million in this period, using prices from Bitflyer.

*Metaplanet Acquires Additional 1,111 $BTC, Total Holdings Reach 11,111 BTC* pic.twitter.com/7ceEeSh1X4

— Metaplanet Inc. (@Metaplanet_JP) June 23, 2025

Balance Sheet Swells to 11,111 BTC

With the new purchase, Metaplanet’s total stash now stands at 11,111 BTC, worth just over $1.07 billion. Its cost basis for those coins sits at about $95,869 each.

Metaplanet’s shares dipped 3.5% on the day of the announcement, a sign that investors may be worried about how the firm is funding its buy-ups.

Funding Through Bonds And Shares

Based on reports, the company has raised cash via zero-coupon bonds and equity rights since January. It issued over 210 million shares under a program it calls the “210 Million Plan.”

Evo Fund has snapped up many of those bonds and rights. Between May and June 2025, Metaplanet pulled in over $300 million, earmarking every dollar for more Bitcoin.

Ambitious Target Of 210,000 BTC

Metaplanet has set a goal to hold 210,000 BTC by the end of 2027. That is 10 times its current pile. To reach that number, it will need to keep tapping the capital markets—and it plans to.

The firm even created a dedicated Bitcoin Treasury Operations arm in December 2024, moving away from its hotel management roots.

Dilution And Risk For Shareholders

Metaplanet’s fully diluted share count rose to close to 760 million as of June 23. That puts its Bitcoin per 1,000 shares at 0.0146 BTC. More bonds and shares mean more dilution for existing investors. If Bitcoin’s price slips, the cost of raising money could climb, eating into any gains from the crypto itself.

Metaplanet’s approach mirrors what some other big holders have done. It’s a bold stance. If Bitcoin holds up or heads higher, the firm could see big returns. But it will need to balance fresh capital raises against the risk of pushing down its own stock.

For now, Metaplanet shows no sign of slowing down its Bitcoin buying. The only real question is how far this strategy can run before the bills come due.

Featured image from Imagen, chart from TradingView