30 January 2026

Bitcoin drifted under $83,000 on Thursday as market focus shifted toward how liquidity is stacked on exchanges. Reports say a mix of big orders and tight ranges has left traders feeling boxed in.

Some analysts warn that a break under a key level could spark sharper selling, while others point to concentrated buy orders that might cushion a drop.

Order-Book Pressure And Liquidity

According to trading-room data, one group or a cluster of large accounts appears to be shaping short-term moves by placing big bids and offers in the order book.

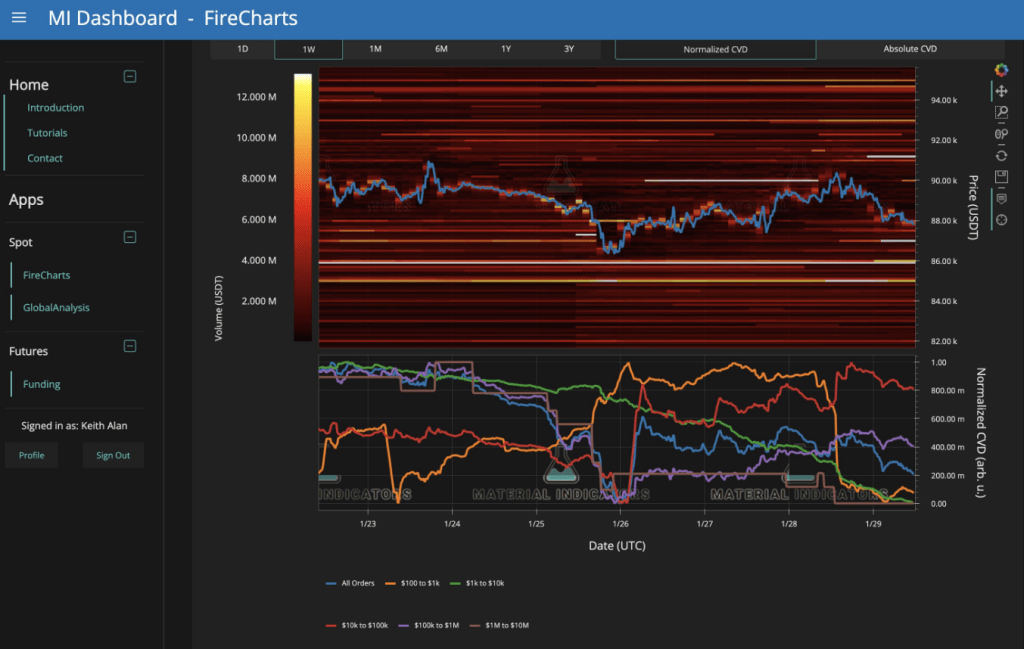

This can keep price stuck in a narrow band. Material Indicators’ research flagged a pattern where bids are clustering around $85,000 to $87,500 — a zone that could act like a floor for now.

The idea is simple: by piling up liquidity at certain prices, large players can get fills on their orders or discourage quick recoveries before options expiry.

Market participants say this kind of behavior can trap less-experienced traders who react to sudden moves. At times, the pressure seems deliberate; at other times, it may be a byproduct of many traders aiming for the same levels. Either way, the result has been choppy price action and rising tension in the book.

FireCharts shows $BTC price is being suppressed by one entity using a liquidity herding strategy to push price lower, potentially to get their own bids filled, or possible to keep price pinned in the lower end of this range before Friday’s options expiry.

A significant amount of… pic.twitter.com/c63miAxBkh

— Material Indicators (@MI_Algos) January 29, 2026

Whales, Wyckoff And The Spring Idea

Reports note that a group of traders using Wyckoff-style thinking expects a “spring” — a drop below recent lows that then leads to a strong bounce as heavy hands buy at lower prices.

Pseudonymous analysts have pointed to $86,000 as a strong buy wall provided by large orders. One commentator shared charts showing how a quick dip under $80,000 could serve as the spring before a rebound.

Some traders view this pattern as part of accumulation. Others see it as a risky setup that could widen losses if support fails. The truth may sit between those views: both accumulation and the risk of a flush are possible in a tense market.

Bitcoin Price Action

Bitcoin has been moving in a tight range after failing to hold above $90,000. Price slid near $82,300 as fresh worries about monetary policy and world events hit risk assets.

Volatility has been low at times and then spikes quickly, which makes trading tricky. Buyers have stepped in at certain levels, but they have not yet forced a clear break higher.

Geopolitics And Fed Moves

Reports say rising tensions in parts of the Middle East and talk about a new Federal Reserve chair pick have added to uncertainty.

Some investors fear tighter policy would drain liquidity from markets and weigh on crypto. Market chatter has even mentioned US President Donald Trump in relation to political shifts that could influence economic policy.

Safe-haven flows into other assets have been seen when headlines worsen, and those moves have pulled money away from riskier holdings.

Key Levels To Watch

Traders should watch the $83,000–$85,000 zone closely. A daily close below $86,000 would be read by many as a negative sign and could open the door to deeper selling. On the flip side, sustained buying at those levels could set up a rally if big liquidity holders decide to lift offers.

For most people, patience and clear stop rules matter right now, because the market is being pushed by both order-book tactics and outside news, and either factor can shift price fast.

Featured image from Unsplash, chart from TradingView