28 November 2025

Crypto analyst Charting Guy (@ChartingGuy) is mapping out a sharply asymmetric setup for XRP, arguing that the token is locked in a textbook Wyckoff reaccumulation and is “still NOT bearish in the slightest” despite a year of range-bound trading.

Why XRP Is Still Not Bearish

His work is based on XRP/USD Bitstamp charts posted on X on 27 November 2025. On the weekly view, XRP trades around $2.23 after an 8–9% gain on the week, consolidating below the 2025 peak at approximately $3.317, which he marks as the 1.0 Fibonacci level. The retracement is drawn from the cycle low near $0.11400 up to that high, producing a ladder of levels that structure the entire thesis.

Key Fibonacci levels include 0.5 at about $0.61495, 0.618 at $0.91531, 0.702 just above $1.20 and, crucially, 0.786 at $1.61246. A broad highlighted band covers the prior 2021 high zone and this 0.786 cluster, roughly from the mid-$1s into the low-$2s. Charting Guy describes this as XRP “building support on prior cycle high as well as top of golden pocket,” referring to the 0.618–0.786 retracement area.

Above the 2025 high, he plots classic Fibonacci extensions: 1.272 at about $8.29661, 1.414 around $13.38940 and 1.618 near $26.63038. His immediate scenario, however, stops short of those levels, projecting a move toward roughly $7.50.

XRP Price Roadmap For 2026

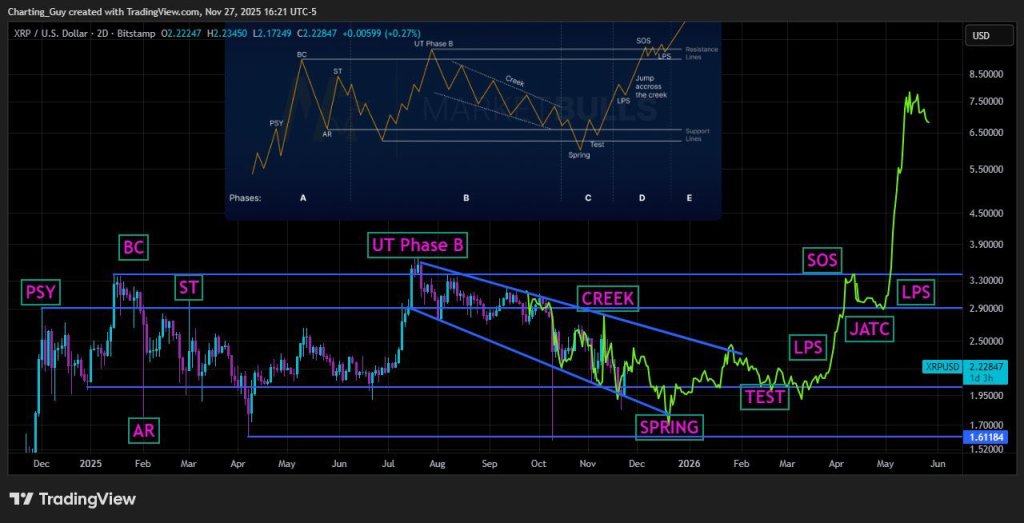

The detailed roadmap appears on a two-day XRP/USD chart overlaid with a Wyckoff schematic. The structure begins with a Preliminarily Supply (PSY) phase and a Buying Climax (BC) into the low-$3 zone, followed by a Secondary Test (ST) and an Automatic Reaction (AR) that defines the lower boundary of the range. Horizontal lines mark that floor near $1.61184, an intermediate band around $1.95, resistance at approximately $2.90 and the upper ceiling just above $3.30.

During mid-2025, XRP prints an “UT Phase B” upthrust into that $3+ resistance before rolling into a downward-sloping channel. The upper boundary of this channel, labeled “CREEK,” connects a series of lower highs, while the lower boundary guides price back toward the $1.61–1.70 support.

In the scenario path, XRP spikes down to test the blue horizontal at $1.61184. This move is annotated as the “SPRING” — Wyckoff’s final shakeout below range support. Price then rebounds to retake the $1.95 area, marked “TEST,” and establishes a higher low between roughly $2.00 and $2.20 as the first “LPS” (Last Point of Support).

From there, the schematic shows a decisive break of the descending “CREEK” trendline, the “JATC” or “Jump Across The Creek,” as XRP accelerates from around $2.20–2.30 through the $2.90 resistance. That breakout is followed by a “SOS” (Sign of Strength) above the former ceiling, with another LPS holding around the $2.90 region and confirming the flip of resistance into support.

The right edge of the 2D chart then projects a steep markup phase. XRP rallies from roughly $3.00 to just above $7.50 before stalling, even though it remains below the 1.272 weekly extension at $8.29661.

Alongside the charts, Charting Guy pushes back against bearish momentum narratives centered on the monthly RSI. He notes that the RSI peak occurred in January 2025 and “lost momentum ALL 2025 while XRP stayed sideways in a range and held its own,” calling this “a very textbook reaccumulation signal where indicators lose steam to reset and price stays stable.”

The technical message is unambiguous: as long as the $1.61–1.70 band holds, Charting Guy views XRP’s extended consolidation as preparation, not distribution—anticipating a final flush below $1.70, followed by a Wyckoff-style breakout sequence toward approximately $7.50.

At press time, XRP traded at $2.23.