28 January 2026

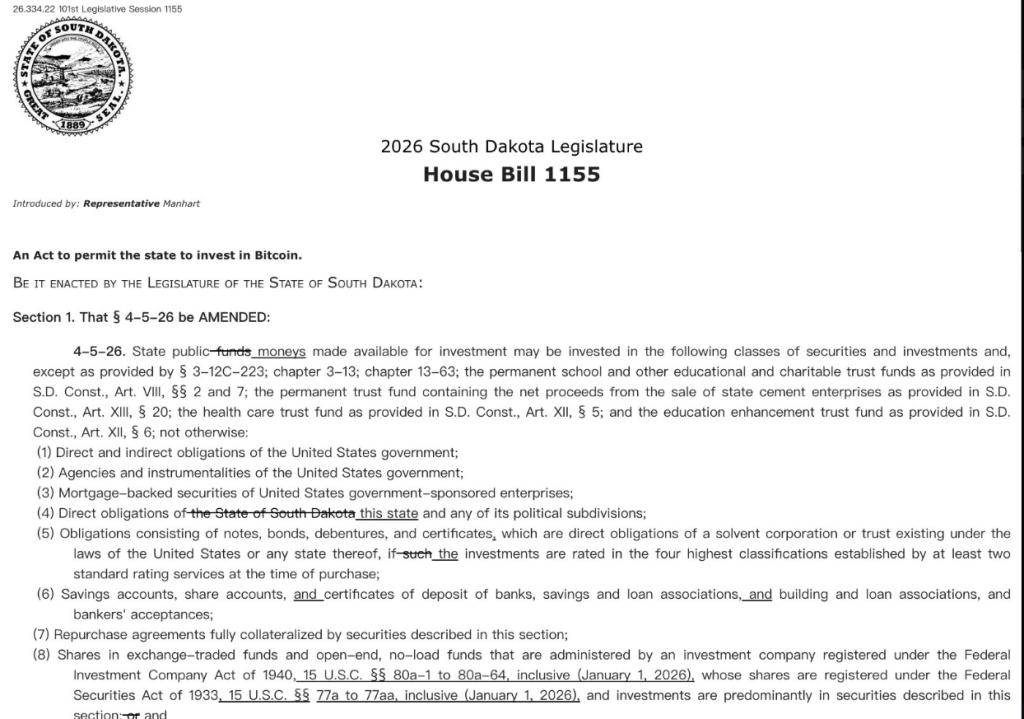

South Dakota has a new bill on the table that would let the state put up to 10% of certain public funds into Bitcoin. Reports say Rep. Logan Manhart filed House Bill 1155 this week, restarting an effort that stalled last year.

The measure would change state investment rules to give the State Investment Council explicit authority to hold Bitcoin in its portfolio.

Lawmaker Files Bill For Bitcoin Reserve

According to filings and public posts, Manhart’s proposal mirrors a move he tried in 2025 and keeps a clear cap on exposure: 10% of the moneys made available for investment.

The bill text says the limit “may not exceed 10%” and lays out options for how the exposure could be taken, including direct holdings or regulated products.

A South Dakota lawmaker is reviving a push to bring bitcoin into state finances.

Republican Rep. Logan Manhart introduced House Bill 1155, which would allow the state to invest up to 10% of eligible public funds in bitcoin.

It’s a renewed effort after a similar bill stalled… pic.twitter.com/hPBbiSB6zT

— Timmy Shen (@timmyhmshen) January 28, 2026

The new push comes after last year’s proposal was deferred in committee. Reports note that HB 1202 was put aside during the 2025 session and did not advance, and Manhart signaled he would try again in 2026.

That history matters because it shows the idea has support in some corners but also faces practical and political hurdles.

What The Bill Allows

Based on reports, the bill not only sets a 10% ceiling but also tries to handle custody and security concerns. It mentions requirements such as using qualified custodians or exchange-traded products, encrypted storage, and multi-signature controls.

Those rules are aimed at lowering the risks that come with holding a volatile asset with public money.

Supporters say Bitcoin could act as a hedge and add a new type of asset to the state’s mix. Opponents point to volatility and possible legal or accounting issues when state funds are used in this way.

The debate will likely hinge on how the State Investment Council evaluates risk and which funds would be considered “eligible” under the bill’s language.

Political And Financial Pushback

There is practical pushback from fiscal watchdogs and some lawmakers who worry about public perception. Money managed for things like pensions carries duty of care.

That duty was stressed last session and will be raised again now that the bill is back. The point has been made plainly and will shape committee hearings.

Featured image from Unsplash, chart from TradingView