28 July 2025

Wirehouse advisors are finding a new way to give clients a taste of Bitcoin and Ethereum without asking them to wrestle with private keys or new wallets.

They’re pointing clients toward shares in companies like Strategy (MSTR) and Bitmine Immersion Technologies (BMNR). Those stocks hold or mine crypto directly, so owning a share is almost like owning a slice of Bitcoin or Ether itself.

Treasury Stocks Offer Direct Crypto Exposure

According to recent filings, Ark Invest bought about 4.4 million shares of BMNR, a position worth roughly $175 million. That move highlights how big investors view treasury stocks: they’re a familiar vehicle wrapped around digital assets.

Strategy, for example, has nearly 200,000 BTC on its balance sheet. Bitmine runs mining rigs in Texas and Canada. By picking these stocks, clients get qualified audits, clear tax forms, and the usual oversight that comes with public companies.

Robinhood offering a 2% match for crypto transfers, and VCs and other investors shifting staked ETH into Treasury companies (DATs) to double their money when lockups expire. As with $MSTR $BMNR,Treasury stocks are a way wirehouse advisors can give clients exposure to BTC and ETH. https://t.co/CzxOudBSTl

— Cathie Wood (@CathieDWood) July 26, 2025

A Safer Bet For Investors

Advisors consider that setup safer than telling clients to hold coins in a self‑custodied wallet. It also cuts through some of the more confusing bits of crypto taxes. Instead of a 1099‑B for every sale, you might only see a single line item covering gains or losses on your brokerage statement.

A 1099-B is a tax form used in the US to report capital gains and losses from the sale of securities and other financial instruments.

For many investors who still find blockchain a bit foreign, this route feels more like buying energy or software shares.

Robinhood’s Bonus Spurs Transfers

Beyond the equity route, Robinhood is trying its own trick to nudge people toward the broader crypto ecosystem. According to Ark Invest CEO Cathie Wood’s post on X, the platform now offers a 2% reward when users transfer crypto off Robinhood into their own wallets.

That small boost can cover transaction fees, or even leave a bit of extra crypto in the user’s pocket. It’s an incentive to explore DeFi apps or staking services outside of Robinhood’s walls.

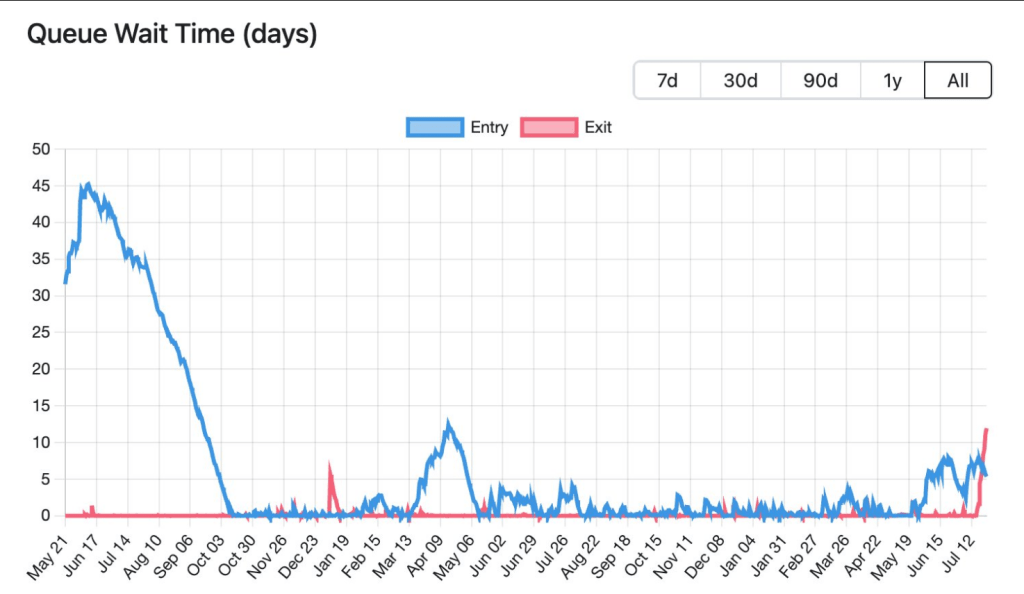

The move tracks closely with Ethereum’s recent staking unlocks. As lockups on ETH expire, wallets are once again able to send tokens freely. Platforms want to capture that flow. By front‑loading a transfer credit, Robinhood hopes to win new users on the promise of more yield down the road.

Featured image from Pexels, chart from TradingView