11 May 2025

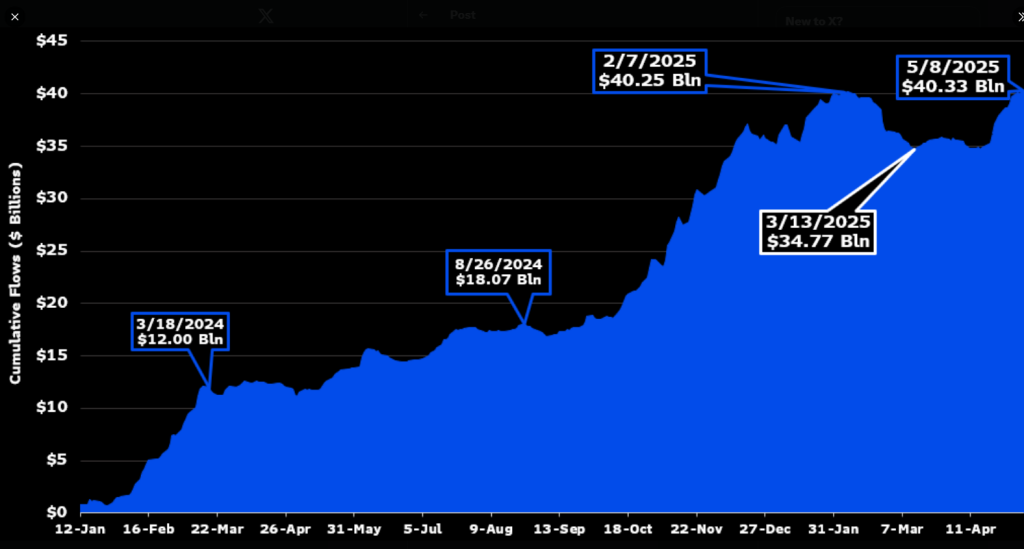

Based on figures that Bloomberg analyst James Seyffart has shared, spot Bitcoin ETFs have already attracted over $40 billion in lifetime inflows. On May 8, 2025, investors pumped new money in, taking the total to $40 billion. That number indicates that individuals continue purchasing Bitcoin using regulated funds. It also reflects increased confidence from everyday savers as well as large companies.

Spot ETF Inflows Hit New High

The leap to $40.33 billion followed recent inflows on May 8. Funds alone totaled more than the previous record on that single day. Investors have been putting money into the products since their launch early in 2024. Their firm hand has kept ETF flows rising even as prices fluctuated.

After yesterdays inflows, the spot Bitcoin ETFs are now at a new high water market for lifetime flows. Currently at $40.33 billion according to Bloomberg data h/t @EricBalchunas pic.twitter.com/0GKPNlmprs

— James Seyffart (@JSeyff) May 9, 2025

Growth Since Launch

When US spot Bitcoin ETFs launched in about March 2024, total lifetime inflows was approximately $12 billion. Through August 2024, that figure had increased to about $18 billion.

Fast-forward to March 2025, and all-time flows were at nearly $35 billion. They broke the $40 billion barrier in only two more months. That steady increase indicates that interest continues unabated in Bitcoin exposure in the form of a plain-vanilla fund, or no-frills investment vehicle.

Institutional Investors Push Demand

Big money investors are piling in. Asset managers and hedge funds are now using ETFs to invest in Bitcoin rather than chasing coins individually. It adds a safety layer and hedging for large portfolios, say analysts.

It also introduces more scrutiny from regulators, as these ETFs will have to be strictly regulated. Some predict that this change might make Bitcoin seem more like a normal asset.

Fans Have Their Say

Social media responses were hot following the milestone. “Bitcoin is dominating,” posted one user, a line of slang that indicates Bitcoin is overwhelming other assets. Others complimented the ability to achieve buy‑in through regulated channels. None expressed any concerns, although some fear Bitcoin price slowdowns could decelerate ETF flows.

The rise above $40 billion is a definite indicator that such ETFs have gained a piece of the market. However, they’re only one of the means through which Bitcoin is held. Miners, open exchange traders, and off-exchange trades all transfer bigger amounts.

In the future, observers will eye ETF flows as a sentiment gauge. If more money streams in, it might be an indication of new confidence. If the tide goes out, it might indicate that buyers are finding alternatives.

Featured image from Unsplash, chart from TradingView